🚖 Réservez votre chauffeur en quelques clics et profitez d’un service rapide, fiable et confortable. - TaxiLight

C’est Parti pour votre Trajet !

Effectuez votre Réservation

Votre trajet en toute sérénité ! Avec TaxiLight

Réservez votre chauffeur en quelques clics et profitez d’un service rapide, fiable et confortable.

Pourquoi Réserver un Chauffeur Avec TaxiLight ?

Découvrez pourquoi choisir TaxiLight pour tous vos déplacements. Avec notre service fiable, confortable et sécurisé, vous pouvez voyager en toute tranquillité d'esprit, où que vous alliez.

Paiement sécurisé

Sécurité absolue pour vos transactions en ligne.

Réservation facile

Réservez rapidement et en toute simplicité.

Commodités gratuites

Profitez de services gratuits et pratiques.

Meilleures offres

Découvrez nos meilleures promotions dès maintenant.

Pas cher que les autres

Les tarifs les plus compétitifs du marché.

Les mieux notés

Les choix les plus appréciés par nos clients.

Assistance 24h/7

Assistance disponible à tout moment, sans interruption.

Remboursement

Remboursement rapide et sans tracas garanti.

Comment ça marche ?

Réserver un chauffeur avec TaxiLight n’a jamais été aussi simple. Suivez ces trois étapes pour un trajet en toute sérénité.

Demandez une course

Indiquez votre point de départ et votre destination, puis sélectionnez le options qui vous convient..

Suivez votre chauffeur

Recevez une confirmation instantanée, suivez votre chauffeur en temps réel et préparez-vous à embarquer.

Payez facilement

Réglez votre course facilement avec plusieurs options de paiement : carte bancaire, portefeuille électronique ou en espèces.

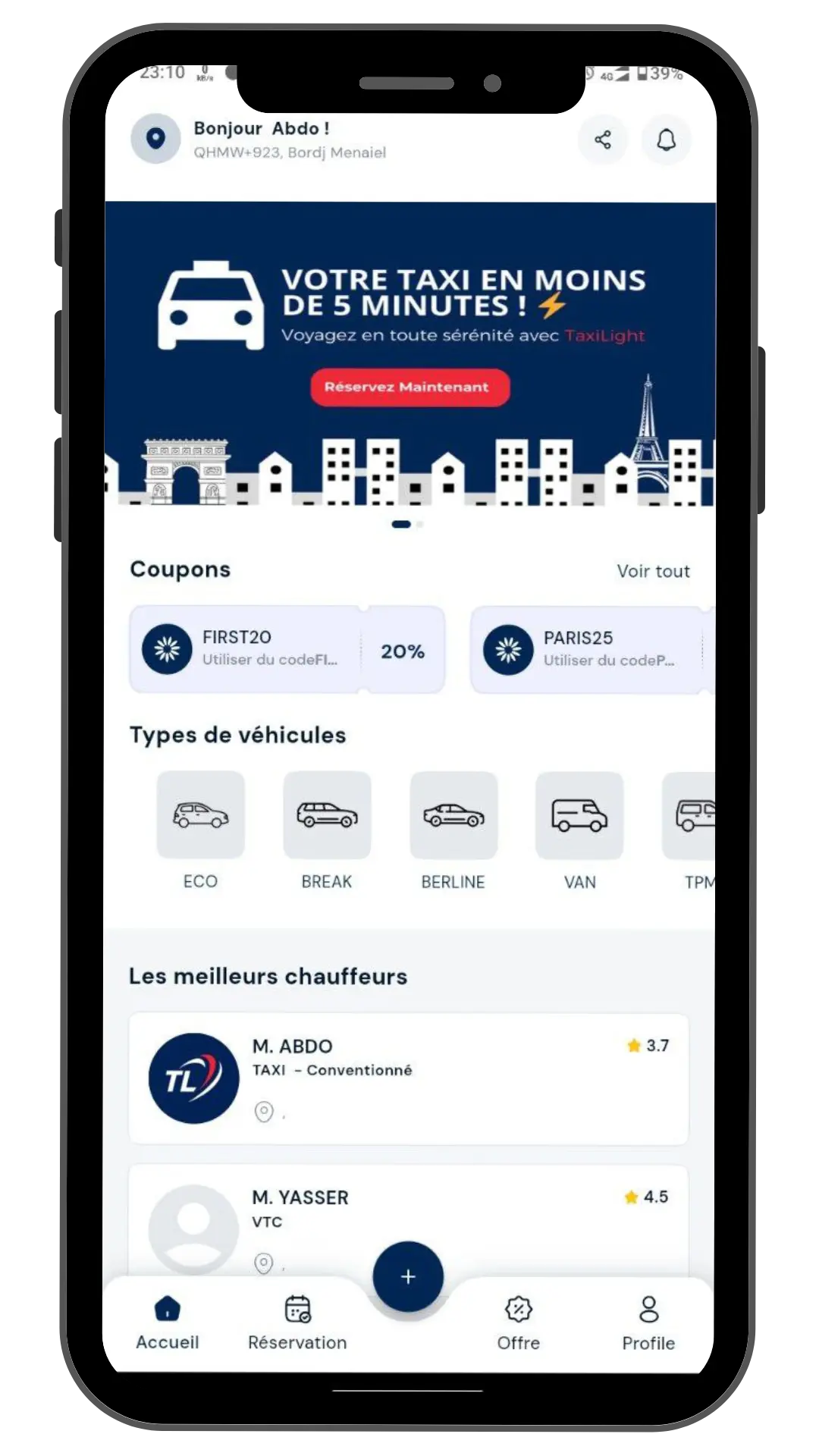

Découvrez les Avantages de l'Application TaxiLight

Avec TaxiLight, réservez votre chauffeur en toute simplicité et profitez d’une expérience fluide et sécurisée. Grâce à des fonctionnalités innovantes, chaque trajet devient plus rapide, plus pratique et plus agréable.

Réservez à Tout Moment

Profitez de la possibilité de réserver un chauffeur 24/7, où que vous soyez, directement depuis votre smartphone.

Suivi en Temps Réel

Suivez l'arrivée de votre chauffeur en temps réel, recevez des estimations précises et restez informé tout au long de votre trajet.

Paiements Sécurisés

Réglez votre course en toute sécurité via l’application avec votre mode de paiement préféré,

Expérience Personnalisée

Enregistrez vos destinations favorites, choisissez votre type de véhicule et profitez d’un service adapté à vos besoins.

Estimation Instantanée du Tarif

Obtenez une estimation du prix avant de valider votre course, pour une totale transparence sans frais cachés.

Offres Exclusives et Promotions

Accédez à des réductions, des programmes de fidélité et des offres promotionnelles réservées aux utilisateurs de l’application.

Transferts d'aéroport

CDG, orly, beauvais, ...

Événements

Mariages, Séminaires,

Transport Touristique

museum, stade, disneyland

Services VIP

soirées privées, hôtel, business

Foire aux questions

Retrouvez ici les réponses aux questions les plus fréquentes sur TaxiLight, pour une expérience de transport simple, rapide et transparente.

Blog et dernières actualités

Restez informé avec les dernières actualités et tendances du transport !